Tuna — Quicksilver is back. Sort of.

Elite Doctors Served Jeffrey Epstein While Treating His ‘Girls’ - The New York Times — If true, all these doctors should be investigated and perhaps lose their medical licenses.

Bucky Linked List

The Quad God and American Reckoning at the Olympics | The New Yorker

My favorite Olympic scandal:

Long bouts of exposure to the wild sometimes drive men crazy. You know the archetype—frozen beard and frantic eyes, a raving, paranoid quality of speech. Maybe this explains the bizarre case of the Norwegian biathlete Sturla Holm Lægreid. After nabbing a bronze medal in the twenty-kilometre biathlon, Lægreid took an interview that quickly became a tearful monologue, not about his sport but about personal matters. Six months ago, he said, he’d met the love of his life. Three months later, amid the chaos of new love and the strictures of training for the Olympics, he’d found time to cheat on his object of affection. “I made my biggest mistake,” he said, choking on tears.

“Sport has come second these last few days,” he said. (Was this a parenthetical excuse for coming in third?) “My only way to solve it is to tell everything and put everything on the table and hope that she can still love me,” he continued. “I have nothing to lose.”

Nothing but his dignity—and the privacy of his already wounded beloved. In the space of a few minutes, Lægreid had managed to make not only the biathlon but the entirety of the Olympics about himself. I felt a pang of sympathy for the guy. He reminded me of an American.

Memory is King, Again - MacSparky

Claude explains scoring in curling

At the 2026 Winter Olympics, Peril and Promise Coincide | The New Yorker

I Will Not Board a Plane to Visit Your Baby | The New Yorker

Claude Cowork is the Most Useful AI on Mac - YouTube

The Devious Mind Behind Wordle | The New Yorker

The Final Adventure begins tonight. Three years in the making (for me).

Deep.

Miami Dolphins: The NFL Team Eating $200 Million to Dismantle Its Roster - WSJ

Exclusive | Trump Administration Considers Requiring Banks to Collect Citizenship Information - WSJ

Exclusive | Bill Gates Apologizes to Foundation Staff Over Epstein Ties - WSJ

How Should Your Suit Fit? A Guide For Men - WSJ

When Do We Become Adults, Really? | The New Yorker

Formula 1: Drive to Survive - Season 8 | First Look | Netflix - YouTube

New A.C.A. Plans Could Increase Family Deductibles to $31,000 - The New York Times

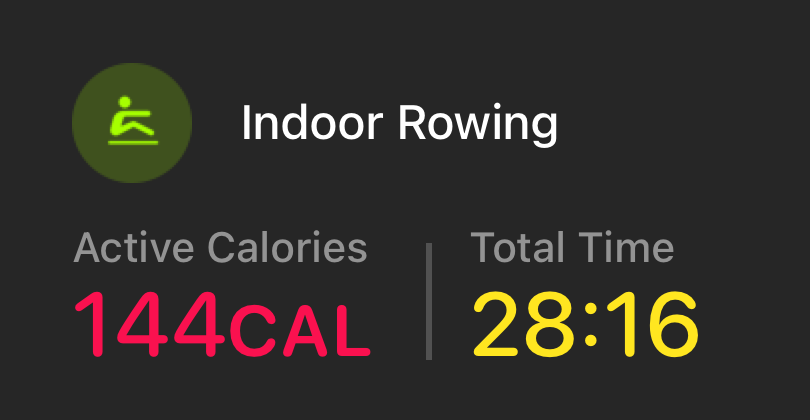

Rogue Move Workout Summary

Date: 02/26/26

Time: 20:00.0

Distance: 3137M

Avg Pace: 3:11.2/500M

Total Calories: 160 cals

Avg Stroke Rate: 20 S/M

Avg Power: 50 watts

Mortal Kombat II | Official Trailer II - YouTube

Schedule recurring tasks in Cowork | Claude Help Center — this is super powerful. It will change the world.

Top 15 New Yorker RSS Feeds | Create New Yorker RSS Feed

4 Takeaways About the U.S. Birthrate Decline - The New York Times

Inside the USS Ford, the Navy’s Newest Aircraft Carrier, as It Heads to Mideast - The New York Times

Schedule recurring tasks in Cowork | Claude Help Center — this is super powerful. It will change the world.

Rogue Move Workout Summary

Date: 02/26/26 Time: 20:00.0 Distance: 3137M Avg Pace: 3:11.2/500M Total Calories: 160 cals Avg Stroke Rate: 20 S/M Avg Power: 50 watts