On the Reverse Flynn Effect - Cal Newport

But as he gathered data to build an up-to-date chart, he was “very surprised” by what he discovered: “IQ has actually started to fall.”

On the Reverse Flynn Effect - Cal Newport

But as he gathered data to build an up-to-date chart, he was “very surprised” by what he discovered: “IQ has actually started to fall.”

Revenge of the Tipping Point a book by Malcolm Gladwell - Bookshop.org US — A truly excellent book. The best way to “read” it is through the audiobook, narrated by Malcolm Gladwell himself.

Your Zodiac Sign Is 2,000 Years Out of Date - The New York Times — Oh no they didn’t!

Healthcare’s Steady Job Growth Is Keeping a Weakening Labor Market Afloat—but for How Long? - WSJ

All told, there are now 23.5 million health-services jobs in the U.S., or about one in six private-sector jobs. That compares with 12.7 million manufacturing jobs, and 15.6 million jobs at retailers. Only the professional and business-services sector, a catchall category that includes everything from lawyers to security guards to telemarketers, comes close, with 22.5 million employees.

[Basic Apple Guy on X: “20 years ago today, Steve Jobs unveiled the iPod nano. t.co/h4sGLW9Xb…” / X](https://x.com/BasicAppleGuy/status/1964712105011253742)

Electric Vehicle vs. Gas Car Calculator - The New York Times

The Top 5 Fountain Pens for Quiet Luxury

You Only Need One TWSBI, But Which??? - YouTube

Pixel 10/Pro Review: Good News and Bad News! - YouTube

‘Out of my control’ – McLaren’s Lando Norris gives verdict on ‘frustrating’ 2025 Formula 1 Dutch Grand Prix retirement — It was rigged.

The Schon DSGN Monoc Nib: Exciting and New! - YouTube

My grail pen. Acquired!

Hemingway Jones (@hemingway_jones) • Instagram photos and videos — As I’ve said before, this man is my hero.

Lando Norris’s Dutch GP agony reshapes his F1 title fight tactics against Piastri - The Athletic — Totally rigged.

Why Aren’t Homeowners Moving as Much as They Used To? - The New York Times

I just realized this today: clothes is not the plural of cloth.

Gen Z Never Learned to Read Cursive - The Atlantic

The Lost Virtue of Cursive | The New Yorker

Learn to Write Cursive - Consistent Cursive

Heidi Gardner and More ‘SNL’ Cast Members Exit Show Ahead of Season 51 - The New York Times

“S.N.L.” was the top-rated broadcast show among viewers ages 18 to 49, the cohort most coveted by advertisers.

Judge Orders Google to Share Search Results to Help Resolve Monopoly - The New York Times

Google must hand over its search results and some of its data to rival companies, a federal judge ruled on Tuesday, a decision that falls short of the sweeping changes proposed by the government to rein in the power of Silicon Valley.

Baby Formula Buying Guide: Types, Safety & Expert Tips - Consumer Reports - High yield.

How to Make Squats Easier on Your Knees - The New York Times

The Pittsburgh Steelers Set Their Playbook on Fire—and Went All-In for a Super Bowl - WSJ

Malcolm Gladwell Talks Sport - YouTube

Emergency Medicine News — How Predictive AI Models Will Reshape Emergency Medicine’s Magic

What Is the Fourier Transform? | Quanta Magazine

The Marriage Effect - The Atlantic

A common narrative has it that commitment and motherhood make women unhappy. New data suggest the opposite is true.

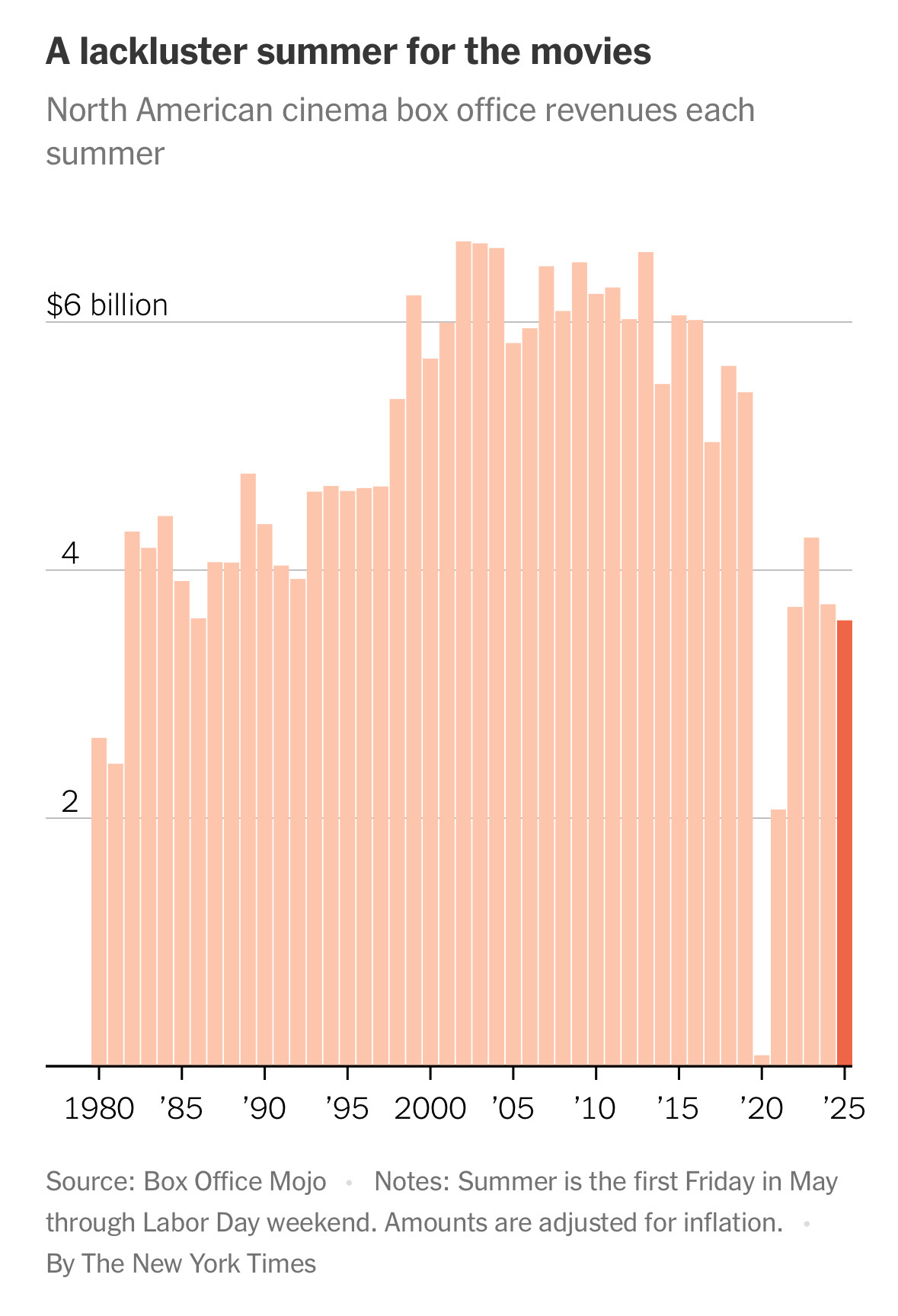

How Hollywood Missed the Mark on Summer Movies This Year - The New York Times

Typography | Apple Developer Documentation

Florida Surgeon General Seeks to End State’s Vaccine Mandates - WSJ — Bad idea.

More kids are getting vaccine exemptions. Here’s where. | USAFacts

The Financial Hack That Built the Eagles Into the NFL’s Super Team - WSJ

Here’s how it works: When a player signs a contract, the two primary components are his salary and bonuses. Salary counts against the cap for the year it’s paid to that player. But the hit from a signing bonus is spread over the length of the contract.

CNBC’s Official NFL Team Valuations 2025

Trump Claims the Power to Summarily Kill Suspected Drug Smugglers - The New York Times

Interesting constitutional questions: When can the President declare that a member of an organized crime syndicate is a military combatant? Can they be killed? Does Congress need to get involved?

#30inks30days September 2025, Day 1 - San Francisco Fog - YouTube

The Moral Problem Of Anakin Skywalker - YouTube

The Wonderful Masculinity of Commander Riker - YouTube

The New Marriage of Unequals - The Atlantic

Trump Claims the Power to Summarily Kill Suspected Drug Smugglers - The New York Times

Interesting constitutional questions: When can the President declare that a member of an organized crime syndicate is a military combatant? Can they be killed? Does Congress need to get involved?

The Financial Hack That Built the Eagles Into the NFL’s Super Team - WSJ

Here’s how it works: When a player signs a contract, the two primary components are his salary and bonuses. Salary counts against the cap for the year it’s paid to that player. But the hit from a signing bonus is spread over the length of the contract.

The Marriage Effect - The Atlantic

A common narrative has it that commitment and motherhood make women unhappy. New data suggest the opposite is true.